Overview

Overview

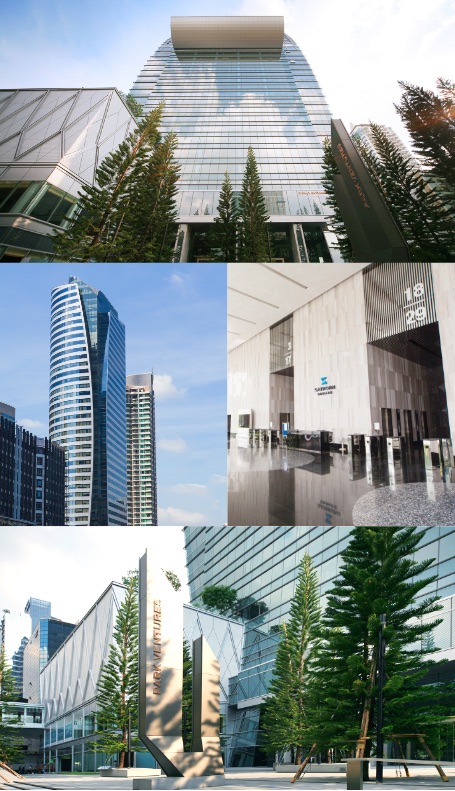

GOLDEN VENTURES REAL ESTATE INVESTMENT TRUST or GVREIT

under the SEC regulation and Capital Market Act B.E.2550 on 22nd March 2016 and listed on the Stock Exchange of Thailand on 4th April 2016. GVREIT entrust Frasers Property Commercial Asset Management (Thailand) Company Limited (Old name Univentures REIT Management Company Limited) as a REIT manager and Kasikorn Asset Management Company Limited as a trustee of the REIT. The core investment of GVREIT is focused on Grade A office building that outstanding in term of architecture, innovation, and novel construction.

Our first Investment was

Investment highlights of GVREIT

prime quality of Grade A office building with distinct architecture and innovative design and construction. Both buildings are also eco-friendly and have received Leadership in Energy and Environmental Design Certificate from U.S. Green Building Council,

LEED Platinum level for Park Ventures Ecoplex

LEED Gold level for Sathorn Square

Moreover, the investment assets are also unique in term of their prime location, in which both of them are located in the Central Business District of Bangkok with direct access to BTS.

Frasers Property Commercial Asset Management (Thailand) Company Limited as a REIT Manager will appoint North Sathorn Realty, which has more than 20 years of managing office projects, to act as a property manager. It is expected that GVREIT will create a good return to investors in the long run in the form of Distribution.